Save 50 percent up front with Etiqa's ePROTECT sMiles usage-based car insurance

01 Aug 2017|22,171 views

Car insurance can be pretty costly and comprehensive plans may not be worth the extra premium, especially if you don't drive a lot. Taking that into consideration, drivers who own off-peak cars are either considering a secondary vehicle without overspending or prefer flexible insurance pricing based on mileage clocked. These drivers typically opt for more affordable options such as third party insurance.

What if we told you that there was an insurance plan, which allows you to save 50 percent up front on your premium? What if you had the option to only pay for the distance you travel without sacrificing quality of coverage? You'd probably say that it sounds too good to be true. But it isn't.

Only pay for the distance you travel, nothing more

Etiqa Insurance has introduced a flexible solution for drivers who may not spend a lot of time on the road. This is none other than ePROTECT sMiles - the company's first usage-based car insurance. As the name suggests, Usage-Based Insurance (UBI) allows you to only pay for the distance you travel in your car.

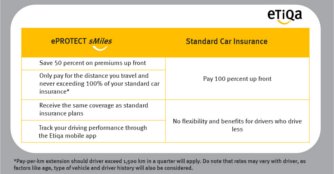

This means you won't have to pay extra for mileage, which you may never use. Standard insurance plans typically require a 100 percent payment up front. Etiqa's UBI, on the other hand, only requires a 50 percent payment up front while the other half is charged based on your mileage clocked; without exceeding 100 percent of your standard car insurance premium.

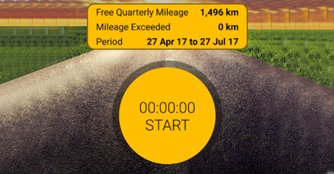

How does this work? You will get a 6,000km annual mileage, which is split into 1,500km per quarter. If you exceed the 1,500km quarterly mileage, you'll simply be charged based on a flat pay-per-km rate at the end of each quarter.

|

Of course, factors such as your age, experience and type of car will be taken into account for the rate. It is worth noting that UBI provides the same coverage as standard insurance plans while offering comprehensive coverage. With this, you will never have to pay more than 100 percent of your standard car insurance premium.

Track your driving performance with the sMiles by Etiqa Insurance app

In order to figure out your actual mileage, you'll have to download the sMiles by Etiqa Insurance mobile app - a telemetric programme that tracks your driving performance.

The app records each journey you make and measures your driving behaviour through parameters such as smoothness, anticipation, cornering and speed. A score between one and five will be generated at the end of each trip, with tips on how you could have achieved a higher score.

The purpose of the telemetric system within the app is to promote better driving habits such as obeying speed limits and consistent driving. It is worth mentioning that receiving a lower score may affect your insurance renewal premium. The sMiles by Etiqa Insurance app is available on both Google Play and the App Store. For more information on Etiqa's usage-based insurance, please visit the Etiqa website.

Etiqa Insurance is located at 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore (048581) and can be contacted at +65 6887 8777 or [email protected].

Car insurance can be pretty costly and comprehensive plans may not be worth the extra premium, especially if you don't drive a lot. Taking that into consideration, drivers who own off-peak cars are either considering a secondary vehicle without overspending or prefer flexible insurance pricing based on mileage clocked. These drivers typically opt for more affordable options such as third party insurance.

What if we told you that there was an insurance plan, which allows you to save 50 percent up front on your premium? What if you had the option to only pay for the distance you travel without sacrificing quality of coverage? You'd probably say that it sounds too good to be true. But it isn't.

Only pay for the distance you travel, nothing more

Etiqa Insurance has introduced a flexible solution for drivers who may not spend a lot of time on the road. This is none other than ePROTECT sMiles - the company's first usage-based car insurance. As the name suggests, Usage-Based Insurance (UBI) allows you to only pay for the distance you travel in your car.

This means you won't have to pay extra for mileage, which you may never use. Standard insurance plans typically require a 100 percent payment up front. Etiqa's UBI, on the other hand, only requires a 50 percent payment up front while the other half is charged based on your mileage clocked; without exceeding 100 percent of your standard car insurance premium.

How does this work? You will get a 6,000km annual mileage, which is split into 1,500km per quarter. If you exceed the 1,500km quarterly mileage, you'll simply be charged based on a flat pay-per-km rate at the end of each quarter.Of course, factors such as your age, experience and type of car will be taken into account for the rate. It is worth noting that UBI provides the same coverage as standard insurance plans while offering comprehensive coverage. With this, you will never have to pay more than 100 percent of your standard car insurance premium.

Track your driving performance with the sMiles by Etiqa Insurance app

In order to figure out your actual mileage, you'll have to download the sMiles by Etiqa Insurance mobile app - a telemetric programme that tracks your driving performance.

The app records each journey you make and measures your driving behaviour through parameters such as smoothness, anticipation, cornering and speed. A score between one and five will be generated at the end of each trip, with tips on how you could have achieved a higher score.

The purpose of the telemetric system within the app is to promote better driving habits such as obeying speed limits and consistent driving. It is worth mentioning that receiving a lower score may affect your insurance renewal premium. The sMiles by Etiqa Insurance app is available on both Google Play and the App Store. For more information on Etiqa's usage-based insurance, please visit the Etiqa website.

Etiqa Insurance is located at 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore (048581) and can be contacted at +65 6887 8777 or [email protected].

Thank You For Your Subscription.