COE Analysis Apr '25: Higher COE quota, high premiums still

08 Apr 2025|15,132 views

COE price trend over the past quarter: Jan to March 2025 vs Oct to Dec 2024

The first quarter of 2025 is officially behind us.

That means that the time is nigh not just to take stock of how well we're keeping to our New Year's Resolutions (still maintaining that thrice-a-week routine at the gym?), but also to look back on how COE premiums have trended so far. This is all the more pertinent considering that at least two events - in January and February each - were likely to have had a huge impact on their movements.

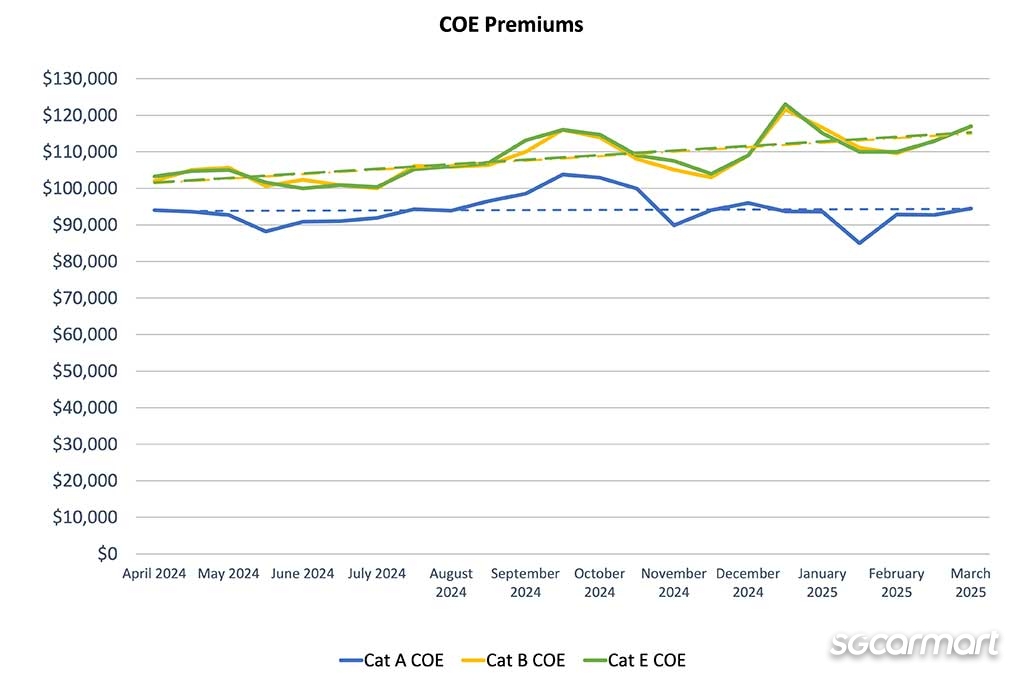

When averaged out across the last three months, Category B (for larger and more powerful cars) and E (the open category) saw their premiums continuing to rise by 5.2% and 4.2% respectively against the previous quarter spanning October to December 2024. On paper, the numbers might seem small, but they nonetheless indicate that demand for cars is continuing to outpace the supply of certificates for these categories. Consequently, the trendlines for both continue to slant upwards.

Conversely, this past quarter saw premiums in Cat A decreasing by 5.8% from where they stood during the October to December 2024 period.

As mentioned earlier, it's worth pointing out that this mixed bag of results was produced in a quarter that played host to two big occurrences within the local car market: One that likely accelerated car-buying demand, and one that certainly boosted the COE quota.

Starting with the latter, the ongoing COE quota period - spanning February to April - marks the first one to be impacted by the LTA's landmark decision to inject 20,000 additional COEs into the pre-existing supply pool.

While it bears repeating that not all of those certificates will be added at once, the quota for the current period is indeed a good deal larger than that for the previous period, with Cats A, B and E all having witnessed an approximate 10% rise. In other words, had car-buying demand held constant, premiums should have slid across the board.

In February's first bidding session - incidentally the first one to benefit from the bumper crop of COEs - this reality was indeed brought to bear: All three categories saw sizeable dips, with Cat A falling to its lowest level since March 2024.

That, however, brings us to the other big occurrence that boosted car-buying demand: The 2025 Singapore Motor Show, which took place on the second weekend of January. Held once again at the Suntec Convention Centre, the event saw a number of big-name launches that included the BYD Sealion 7 and all-new BMW X3, even as big names like Mercedes-Benz, Audi, Toyota and Lexus returned with crowd favourites.

In fact, we theorised that the uniform rise in premiums during the most recent COE bidding session (in late March) - coincidentally the sixth round since the Show concluded - was likely linked to orders made over that weekend. It is common practice for local dealers to offer a six-bid guaranteed COE package when selling cars - meaning that March's 2nd bidding session would have made it their last chance to secure a COE for purchases locked in during the Show.

Amidst the flurry of activity, discourse on the exorbitance of car ownership in Singapore has persisted with fervour.

While the government had initially considered the possibility of carving out a new COE category for private-hire cars (PHCs) in December, it confirmed just last month that it has decided to maintain the status quo of vehicle classification. Instead, efforts will be directed to ensuring more stability in the COE supply pool - with a focus for the immediate future on increasing supply in the coming quarters.

The authorities also rolled out a three-year lock-in period for business-owned PHCs that prevents them from being sold to individual owners or transferred to other businesses for at least three years starting. (The finer technicalities can be found here.)

Car de-registrations over the last 12 months

If you've been following developments in the space for a couple of years now, you should know that predicting the COE quota for the upcoming period has become an increasingly uphill task.

Although the bulk of it is still influenced by a 12-month rolling average of vehicle de-registrations (built off the original calculation method of depending solely on certificates being returned to the pool), the authorities spent the entirety of 2024 relying on the cut-and-fill method to bolster supply. Now, the extra injection of 20,000 COEs over the next few years adds another entirely opaque variable.

On the flip side, the key upshot remains; the authorities have promised that the COE quota for every successive quarter from hereon will be higher than the previous one, at least until COE supply reaches its expected peak in a couple of years.

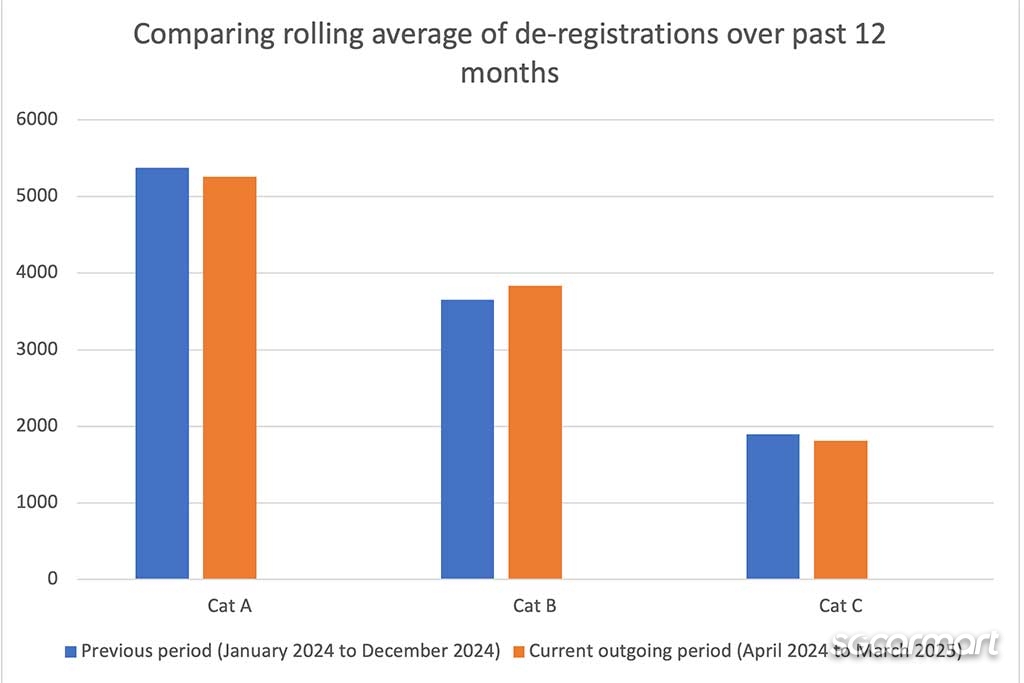

To car buyers, this absolute certainty should be comforting - especially because the original calculation method of relying exclusively on de-registrations inevitably means more volatility. Our analysis this time presents a good example: By extrapolating data from April 2024 to February 2025 out across 12 months, numbers indicate that the overall rolling average of de-registrations for the April 2024 to March 2025 period will be slightly lower than that in the previous 12-month period (January to December 2024).

The decrease in de-registrations appears to be influenced by Cat A, whose rolling average is forecast to slide by 2.2% from 5,379, and Cat C for commercial vehicles, for which a sharper 4.5% dip is expected.

Only Cat B's de-registrations are forecast to rise - by 4.9% - from a rolling average of 3,655 previously.

Omitting the aforementioned interventions by the LTA, the decrease in de-registrations would have contributed to a dip in the COE quota for the upcoming quarter.

New car pricing: January to March 2025

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

In line with the mixed bag of movements in COE premiums mentioned earlier (a slight dip in Cat A; slight increases conversely for Cat B and E), the sample of models we analyse reflected an extremely meagre 1% increase in new car prices over the first quarter of 2025, compared to the tri-monthly average between October to December last year.

The increase once more suggests that dealers have been committed quite consistently to keeping the sticker prices of their cars in close step with how COE premiums are trending. In particular, that first bidding round of February we mentioned earlier also resulted in dealers dropping prices across the board for their Cat A-eligible and Cat B-classified cars.

At the time of writing, entry-level bestselling models in Singapore, such as the BYD Atto 3, are retailing in the mid $160,000-range, while more premium Cat B cars such as the Toyota Harrier Hybrid stand above $260,000 (both inclusive of COE).

Most popular used cars: December 2024 to February 2025

Over the three-month period between December 2024 to February 2025, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,612 |

| Honda Civic 1.6A VTi | 2018 | $14,096 |

| Nissan Qashqai 1.2A DIG-T | 2017 | $10,926 |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $18,072 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $18,114 |

Using the 2016-registered Honda Vezel as our yardstick again, the stabilisation of the new car market appears to be having a persisting cooling off effect on used car prices.

Against the figures we saw in our last analysis, the average annual depreciation for the Vezel is now closer to the $12,500 mark - compared to nearly $13,000 in the previous period. (For context, the Vezel had an average annual depreciation figure of $15,430 at the same point last year.)

Similar dips apply not just to other popular mass market models, like the 2017-registered Nissan Qashqai 1.2 Turbo and 1.6-litre variant of the Honda Civic, but even luxury models like the 2017 and 2018 registered Mercedes-Benz C180 Avantgarde (albeit to a less pronounced degree).

Here's a recount of our past three analyses!

Dec '24 COE Analysis: Recounting another unprecedented year

Late COE Analysis Oct '24: Premiums still trending upwards

COE Analysis July '24: Is $90-100k the new normal?

COE price trend over the past quarter: Jan to March 2025 vs Oct to Dec 2024

The first quarter of 2025 is officially behind us.

That means that the time is nigh not just to take stock of how well we're keeping to our New Year's Resolutions (still maintaining that thrice-a-week routine at the gym?), but also to look back on how COE premiums have trended so far. This is all the more pertinent considering that at least two events - in January and February each - were likely to have had a huge impact on their movements.

When averaged out across the last three months, Category B (for larger and more powerful cars) and E (the open category) saw their premiums continuing to rise by 5.2% and 4.2% respectively against the previous quarter spanning October to December 2024. On paper, the numbers might seem small, but they nonetheless indicate that demand for cars is continuing to outpace the supply of certificates for these categories. Consequently, the trendlines for both continue to slant upwards.

Conversely, this past quarter saw premiums in Cat A decreasing by 5.8% from where they stood during the October to December 2024 period.

As mentioned earlier, it's worth pointing out that this mixed bag of results was produced in a quarter that played host to two big occurrences within the local car market: One that likely accelerated car-buying demand, and one that certainly boosted the COE quota.

Starting with the latter, the ongoing COE quota period - spanning February to April - marks the first one to be impacted by the LTA's landmark decision to inject 20,000 additional COEs into the pre-existing supply pool.

While it bears repeating that not all of those certificates will be added at once, the quota for the current period is indeed a good deal larger than that for the previous period, with Cats A, B and E all having witnessed an approximate 10% rise. In other words, had car-buying demand held constant, premiums should have slid across the board.

In February's first bidding session - incidentally the first one to benefit from the bumper crop of COEs - this reality was indeed brought to bear: All three categories saw sizeable dips, with Cat A falling to its lowest level since March 2024.

That, however, brings us to the other big occurrence that boosted car-buying demand: The 2025 Singapore Motor Show, which took place on the second weekend of January. Held once again at the Suntec Convention Centre, the event saw a number of big-name launches that included the BYD Sealion 7 and all-new BMW X3, even as big names like Mercedes-Benz, Audi, Toyota and Lexus returned with crowd favourites.

In fact, we theorised that the uniform rise in premiums during the most recent COE bidding session (in late March) - coincidentally the sixth round since the Show concluded - was likely linked to orders made over that weekend. It is common practice for local dealers to offer a six-bid guaranteed COE package when selling cars - meaning that March's 2nd bidding session would have made it their last chance to secure a COE for purchases locked in during the Show.

Amidst the flurry of activity, discourse on the exorbitance of car ownership in Singapore has persisted with fervour.

While the government had initially considered the possibility of carving out a new COE category for private-hire cars (PHCs) in December, it confirmed just last month that it has decided to maintain the status quo of vehicle classification. Instead, efforts will be directed to ensuring more stability in the COE supply pool - with a focus for the immediate future on increasing supply in the coming quarters.

The authorities also rolled out a three-year lock-in period for business-owned PHCs that prevents them from being sold to individual owners or transferred to other businesses for at least three years starting. (The finer technicalities can be found here.)

Car de-registrations over the last 12 months

If you've been following developments in the space for a couple of years now, you should know that predicting the COE quota for the upcoming period has become an increasingly uphill task.

Although the bulk of it is still influenced by a 12-month rolling average of vehicle de-registrations (built off the original calculation method of depending solely on certificates being returned to the pool), the authorities spent the entirety of 2024 relying on the cut-and-fill method to bolster supply. Now, the extra injection of 20,000 COEs over the next few years adds another entirely opaque variable.

On the flip side, the key upshot remains; the authorities have promised that the COE quota for every successive quarter from hereon will be higher than the previous one, at least until COE supply reaches its expected peak in a couple of years.

To car buyers, this absolute certainty should be comforting - especially because the original calculation method of relying exclusively on de-registrations inevitably means more volatility. Our analysis this time presents a good example: By extrapolating data from April 2024 to February 2025 out across 12 months, numbers indicate that the overall rolling average of de-registrations for the April 2024 to March 2025 period will be slightly lower than that in the previous 12-month period (January to December 2024).

The decrease in de-registrations appears to be influenced by Cat A, whose rolling average is forecast to slide by 2.2% from 5,379, and Cat C for commercial vehicles, for which a sharper 4.5% dip is expected.

Only Cat B's de-registrations are forecast to rise - by 4.9% - from a rolling average of 3,655 previously.

Omitting the aforementioned interventions by the LTA, the decrease in de-registrations would have contributed to a dip in the COE quota for the upcoming quarter.

New car pricing: January to March 2025

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

In line with the mixed bag of movements in COE premiums mentioned earlier (a slight dip in Cat A; slight increases conversely for Cat B and E), the sample of models we analyse reflected an extremely meagre 1% increase in new car prices over the first quarter of 2025, compared to the tri-monthly average between October to December last year.

The increase once more suggests that dealers have been committed quite consistently to keeping the sticker prices of their cars in close step with how COE premiums are trending. In particular, that first bidding round of February we mentioned earlier also resulted in dealers dropping prices across the board for their Cat A-eligible and Cat B-classified cars.

At the time of writing, entry-level bestselling models in Singapore, such as the BYD Atto 3, are retailing in the mid $160,000-range, while more premium Cat B cars such as the Toyota Harrier Hybrid stand above $260,000 (both inclusive of COE).

Most popular used cars: December 2024 to February 2025

Over the three-month period between December 2024 to February 2025, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,612 |

| Honda Civic 1.6A VTi | 2018 | $14,096 |

| Nissan Qashqai 1.2A DIG-T | 2017 | $10,926 |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $18,072 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $18,114 |

Using the 2016-registered Honda Vezel as our yardstick again, the stabilisation of the new car market appears to be having a persisting cooling off effect on used car prices.

Against the figures we saw in our last analysis, the average annual depreciation for the Vezel is now closer to the $12,500 mark - compared to nearly $13,000 in the previous period. (For context, the Vezel had an average annual depreciation figure of $15,430 at the same point last year.)

Similar dips apply not just to other popular mass market models, like the 2017-registered Nissan Qashqai 1.2 Turbo and 1.6-litre variant of the Honda Civic, but even luxury models like the 2017 and 2018 registered Mercedes-Benz C180 Avantgarde (albeit to a less pronounced degree).

Here's a recount of our past three analyses!

Dec '24 COE Analysis: Recounting another unprecedented year

Late COE Analysis Oct '24: Premiums still trending upwards

COE Analysis July '24: Is $90-100k the new normal?

Thank You For Your Subscription.