COE supply projected to continue to shrink, causing COE prices to rise

30 Jun 2021|52,236 views

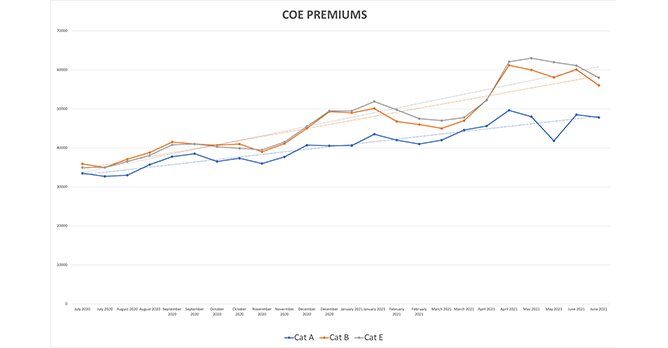

COE price trend over the past quarter

Across the board, COE premiums have seen a quarter-on-quarter increase. Compared to the preceding quarter (Jan to Mar 2021), the average COE price across Apr to Jun 2021 is 10.9% higher for Cat A, 22.5% higher for Cat B, and 22.1% higher for Cat E.

COE prices saw a significant spike in the second bidding round in April, with the impending COE supply shrinkage this quarter. Cat A premiums hit a new high not seen since 2017, while Cat B COE hit a mark not seen since Sep 2015. Thus, the recent dip in COE prices is just a slight correction in the otherwise upwards trend that will likely continue.

For buyers in the market for a new car, it would be prudent to buy now instead of waiting further. COE premiums hit incredible highs in 2012-2013 (eclipsing the $90k mark), so considering the 10 year cycle, it is expected that the coming years will once again be a high mark for COEs as many owners reach the end of their COE cycle and will look to purchase new cars.

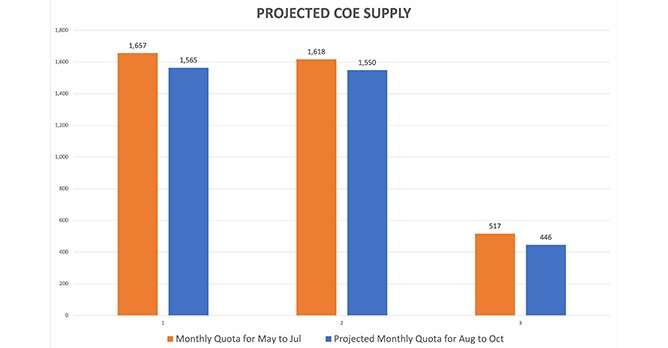

COE supply projection and vehicle deregistration data

Based on statistical forecasting using latest data released by the LTA, the COE supply for the upcoming next Aug to Oct quarter is expected to decrease by 6% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in May to Jun 2020.

For Cat A, COE supply is projected to decrease by 6% from a monthly average of 1,657. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,618. For Cat E, COE supply is projected to decrease by 14% from a monthly average of 517.

The projected decrease in COE supply is expected to put continued upwards pressure on COE prices.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 5.9% quarter on quarter increase in new car prices.

While new car prices have continued to climb, the smaller increase in car prices relative to the significant jump in average COE premiums indicates that while there is still significant buying interest in new cars, it is perhaps waning slightly.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,357/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $16,494/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $10,270/yr |

| Honda Civic 1.6A Vti | 2017 | $10,670/yr |

| Mazda 3 1.5A Sunroof | 2017 | $9,411/yr |

For car owners who may be put off by COE premiums continuing to increase and thus make new cars more expensive, buying a used car may be a more feasible option. The Honda Vezel and Mercedes-Benz C-Class continue to the most popular used cars on sgCarMart. However, just as new car prices have increased, we have also seen the average depreciation of generally go up compared to the previous quarter.

Most of the top listed used cars this quarter tend to be 2016 and 2017 models. This is an indication that in the used car market continues to be quite healthy, with many car owners choosing to upgrade or change cars at around the four to five year mark of their COE cycle.

Also, last year, Grab announced that cars older than 10 years will be steading phased out by 2022. Additionally, cars seven years old and above will be required complete an additional safety and maintenance course. This could explain the significant number of 2016 Honda Vezels being listed (an average of 131 per month), as full-time Grab drivers are perhaps trading in their existing cars for newer models to bypass the necessary course. Moving forward, it is likely that more of such cars will be available in the used car market.

This article was updated on 29 Sep 2022.

COE price trend over the past quarter

Across the board, COE premiums have seen a quarter-on-quarter increase. Compared to the preceding quarter (Jan to Mar 2021), the average COE price across Apr to Jun 2021 is 10.9% higher for Cat A, 22.5% higher for Cat B, and 22.1% higher for Cat E.

COE prices saw a significant spike in the second bidding round in April, with the impending COE supply shrinkage this quarter. Cat A premiums hit a new high not seen since 2017, while Cat B COE hit a mark not seen since Sep 2015. Thus, the recent dip in COE prices is just a slight correction in the otherwise upwards trend that will likely continue.

For buyers in the market for a new car, it would be prudent to buy now instead of waiting further. COE premiums hit incredible highs in 2012-2013 (eclipsing the $90k mark), so considering the 10 year cycle, it is expected that the coming years will once again be a high mark for COEs as many owners reach the end of their COE cycle and will look to purchase new cars.

COE supply projection and vehicle deregistration data

Based on statistical forecasting using latest data released by the LTA, the COE supply for the upcoming next Aug to Oct quarter is expected to decrease by 6% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in May to Jun 2020.

For Cat A, COE supply is projected to decrease by 6% from a monthly average of 1,657. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,618. For Cat E, COE supply is projected to decrease by 14% from a monthly average of 517.

The projected decrease in COE supply is expected to put continued upwards pressure on COE prices.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 5.9% quarter on quarter increase in new car prices.

While new car prices have continued to climb, the smaller increase in car prices relative to the significant jump in average COE premiums indicates that while there is still significant buying interest in new cars, it is perhaps waning slightly.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,357/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $16,494/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $10,270/yr |

| Honda Civic 1.6A Vti | 2017 | $10,670/yr |

| Mazda 3 1.5A Sunroof | 2017 | $9,411/yr |

Most of the top listed used cars this quarter tend to be 2016 and 2017 models. This is an indication that in the used car market continues to be quite healthy, with many car owners choosing to upgrade or change cars at around the four to five year mark of their COE cycle.

Also, last year, Grab announced that cars older than 10 years will be steading phased out by 2022. Additionally, cars seven years old and above will be required complete an additional safety and maintenance course. This could explain the significant number of 2016 Honda Vezels being listed (an average of 131 per month), as full-time Grab drivers are perhaps trading in their existing cars for newer models to bypass the necessary course. Moving forward, it is likely that more of such cars will be available in the used car market.

This article was updated on 29 Sep 2022.

Thank You For Your Subscription.