Cat B COE continues upward rise, and supply for upcoming quarter expected to shrink significantly

05 Oct 2021|22,209 views

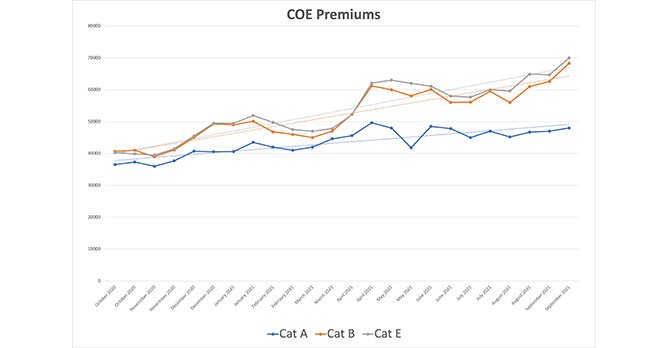

COE price trend over the past quarter

5th October 2021 - COE premiums for larger capacity cars have continued its upward trend, though the upward climb has slightly tapered off. Compared to the preceding quarter (Apr to Jun 2021), the average COE price across Jul to Sep 2021 is 4.5% higher for Cat B, and 5.1% higher for Cat E. In Sep, COE premiums for Cat B and E hit six-year highs. For Cat A COE, premiums have remained largely the same from the preceding quarter, with an quarter-on-quarter drop of just 0.9%.

The trend for COE premiums is projected to continue to rise upwards. COE premiums hit incredible highs across the board in 2012-2013, so premiums in the coming two years are expected to be similarly high. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further.

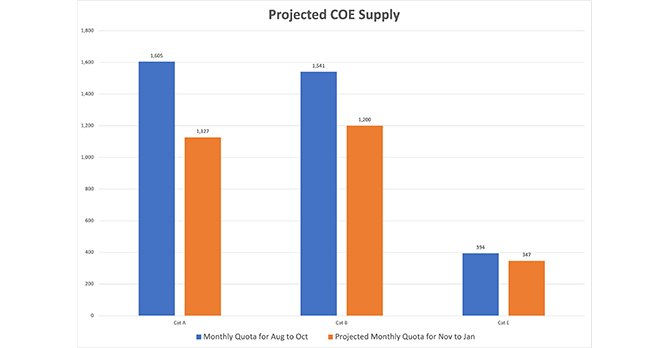

Vehicle deregistration data and COE supply projection

For Cat A, COE quota is projected to decrease by 30% from a monthly average of 1,605. For Cat B, COE quota is projected to decrease by 22% from a monthly average of 1,541. For Cat E, COE quota is projected to decrease by 12% from a monthly average of 394.

The significant shrinkage in COE supply is expected to put increased upward pressure on COE prices.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 6.5% quarter on quarter increase in new car prices.

The average increase in new car prices is proportionate to the increase in Cat B COE premiums, which indicates that car buying demand continues to remain steady compared to the preceding quarter.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,437/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $16,065/yr |

| Toyota Corolla Altis 1.6A Elegance | 2019 | $10,118/yr |

| Honda Civic 1.6A Vti | 2019 | $10,617/yr |

| Mazda 3 1.5A Sunroof | 2017 | $9,159/yr |

The Honda Vezel and Mercedes-Benz C-Class continue to the most popular used cars on sgCarMart. The significant number of 2016 Vezels listed continues the trend from the previous quarter, whereby full-time Grab drivers are likely trading in their existing cars for newer models to bypass the necessary course that seven years and older cars will be required to undertake.

However, the average depreciation for used cars have remained relatively consistent compared to the previous quarter. With most of the used cars being Cat A models, this is not surprising - Cat A COE premiums have remained relatively constant compared to the previous quarter as well.

For car owners who may be put off by COE premiums continuing to increase and thus make new cars more expensive, buying a used car will still be a more feasible option.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

COE price trend over the past quarter

5th October 2021 - COE premiums for larger capacity cars have continued its upward trend, though the upward climb has slightly tapered off. Compared to the preceding quarter (Apr to Jun 2021), the average COE price across Jul to Sep 2021 is 4.5% higher for Cat B, and 5.1% higher for Cat E. In Sep, COE premiums for Cat B and E hit six-year highs. For Cat A COE, premiums have remained largely the same from the preceding quarter, with an quarter-on-quarter drop of just 0.9%.

The trend for COE premiums is projected to continue to rise upwards. COE premiums hit incredible highs across the board in 2012-2013, so premiums in the coming two years are expected to be similarly high. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further.

Vehicle deregistration data and COE supply projection

For Cat A, COE quota is projected to decrease by 30% from a monthly average of 1,605. For Cat B, COE quota is projected to decrease by 22% from a monthly average of 1,541. For Cat E, COE quota is projected to decrease by 12% from a monthly average of 394.

The significant shrinkage in COE supply is expected to put increased upward pressure on COE prices.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 6.5% quarter on quarter increase in new car prices.

The average increase in new car prices is proportionate to the increase in Cat B COE premiums, which indicates that car buying demand continues to remain steady compared to the preceding quarter.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,437/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $16,065/yr |

| Toyota Corolla Altis 1.6A Elegance | 2019 | $10,118/yr |

| Honda Civic 1.6A Vti | 2019 | $10,617/yr |

| Mazda 3 1.5A Sunroof | 2017 | $9,159/yr |

The Honda Vezel and Mercedes-Benz C-Class continue to the most popular used cars on sgCarMart. The significant number of 2016 Vezels listed continues the trend from the previous quarter, whereby full-time Grab drivers are likely trading in their existing cars for newer models to bypass the necessary course that seven years and older cars will be required to undertake.

However, the average depreciation for used cars have remained relatively consistent compared to the previous quarter. With most of the used cars being Cat A models, this is not surprising - Cat A COE premiums have remained relatively constant compared to the previous quarter as well.

For car owners who may be put off by COE premiums continuing to increase and thus make new cars more expensive, buying a used car will still be a more feasible option.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

Thank You For Your Subscription.