Are you using credit cards correctly?

17 May 2024|1,021 views

Tap your card and go. You may find this series of actions familiar, and maybe that's because you perform them every day, multiple times.

We tap to pay for our morning coffee fix, grocery runs, and for the non-drivers, public transport commutes. Rinse, repeat this periodically at the petrol stations for those who drive.

We're talking about making payments with our credit card. There's no two ways about completing transactions using credit cards. But there are scenarios that can put you at a disadvantage if you're not wise with handling it.

Some of these unconscious, self-penalising moments could manifest as instances of repeated fare charges or a taint on your credit score.

Practising secure measures on using credit card(s) gives you a strong start against cyber criminals. Now here are some complementary practices, which you could dish out conscientiously, to fortify your wealth.

Same credit card, multiple fare charges..?

Have you ever encountered situations where you paid more for your train or bus ride than you ought to? You may even have wondered if you had, in a flurry of activity to break free from the bottleneck at the fare gantries, double tapped your card.

Same same but different? Tapping in and out of public transport rides using the same card but on different modes will incur you different fares

More frequently than you might think, though, the reason could be due to the seemingly innocuous act of tapping in and out with different methods.

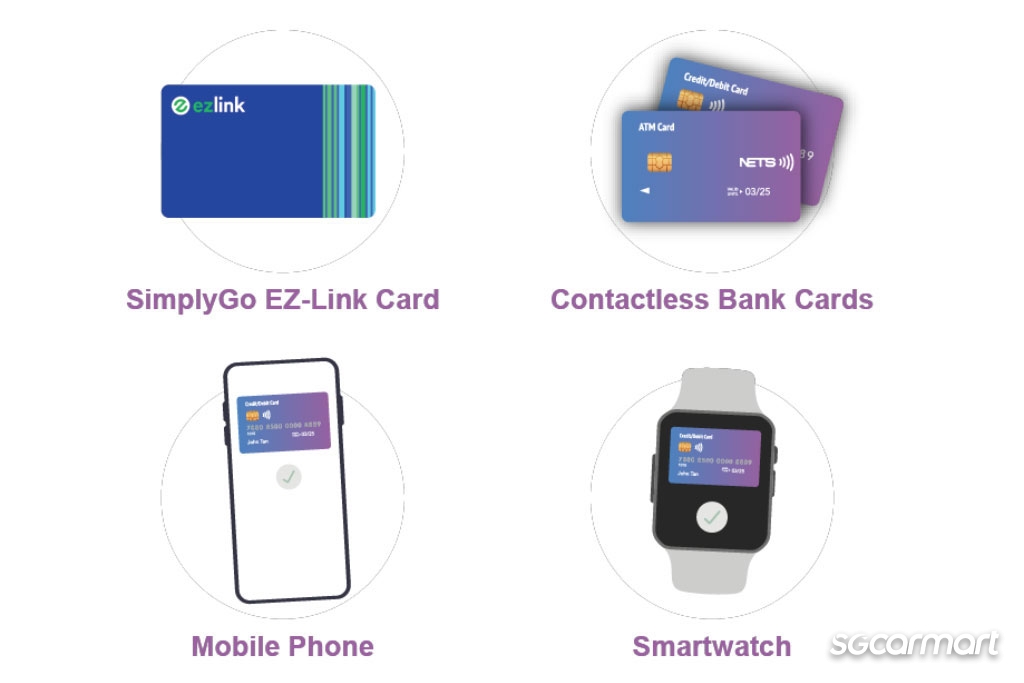

So what counts as a payment method? According to the Land Transport Authority (LTA), these include digital wallets in smartphones, physical credit/debit cards, and smart watches. The important thing to remember is that while these are one with the credit card you own - whether they exist physically or in a virtual form - they aren't the same. Not to the card readers, at least.

This means that if you were to tap in using your credit card then tap out with your smart watch, you will be charged twice the fare you should be paying for your ride. For some reason since systems have not caught up with the technological advances in the accessories we use, we'll have to adapt by adjusting our behaviours.

Whatever you use to tap in, make sure you tap out using the same method.

One less card means one more worry

You might be sitting on a decision to cancel a stack of cards, which you can't seem to all fit in your wallet or cardholder. But it will do you even more good to do some homework before you proceed.

A question you should consider when you're at such a crossroads is: How long have you had your credit card for? Simply because the average length of time you've had credit affects your credit score.

If you own two credit cards, one that's 10 years old and another that's four years old, you have an average of seven years of credit. If you decide to close the 10-year-old card, your credit age then falls to four years.

In short, a longer credit history makes you more credit-worthy and that translates to a better credit score. This also means, the longer you've held on to a credit card improves your score.

There's a good reason for why you shouldn't cancel a credit card even when you don't use it. Doing so potentially reduces your credit score instead of raising it, consumer finance analyst for U.S. News & World Report, Beverly Harzog, told Investopedia.

Closing a credit card account can affect your credit utilisation ratio, a measure of the percentage of credits you have available that's being used. The more available credits used, the higher your credit utilisation ratio will be. This can negatively impact your credit score especially if you cancel a card without having paid your balance in full.

The takeaway here is to exercise judgement when deciding whether or not to cancel a credit card. Even if the impetus may be to avoid excessive spending, declutter your cards, or to protect yourself from the risk of identity theft when you misplace one.

Don't be greedy to sign up for cards

But perhaps the best way to steer clear of the conundrum we've just discussed is simply to be less greedy for credit cards.

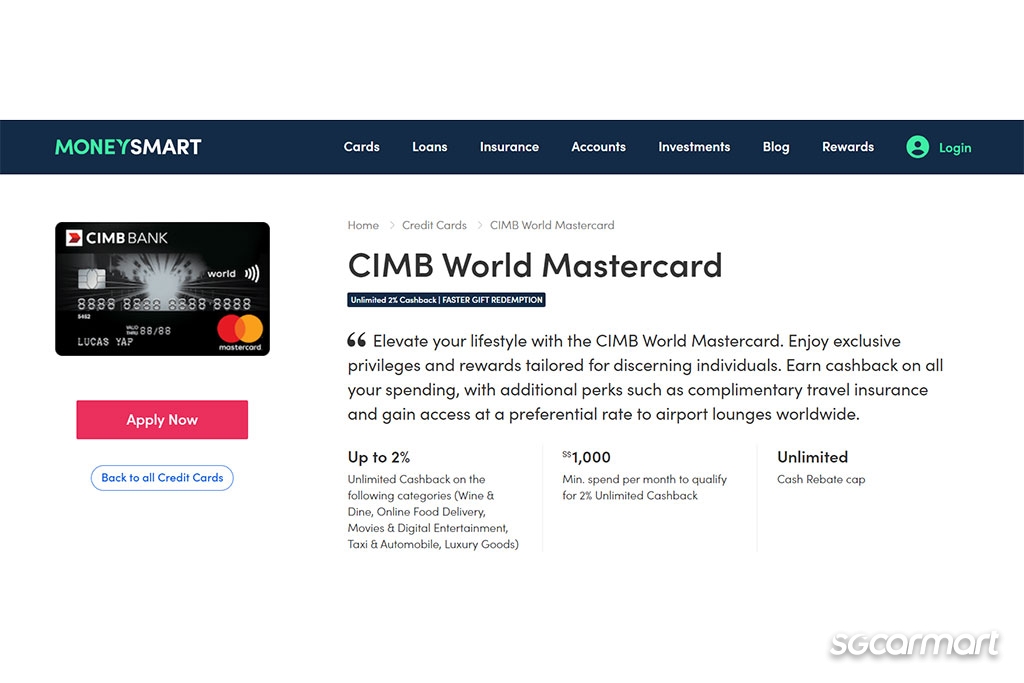

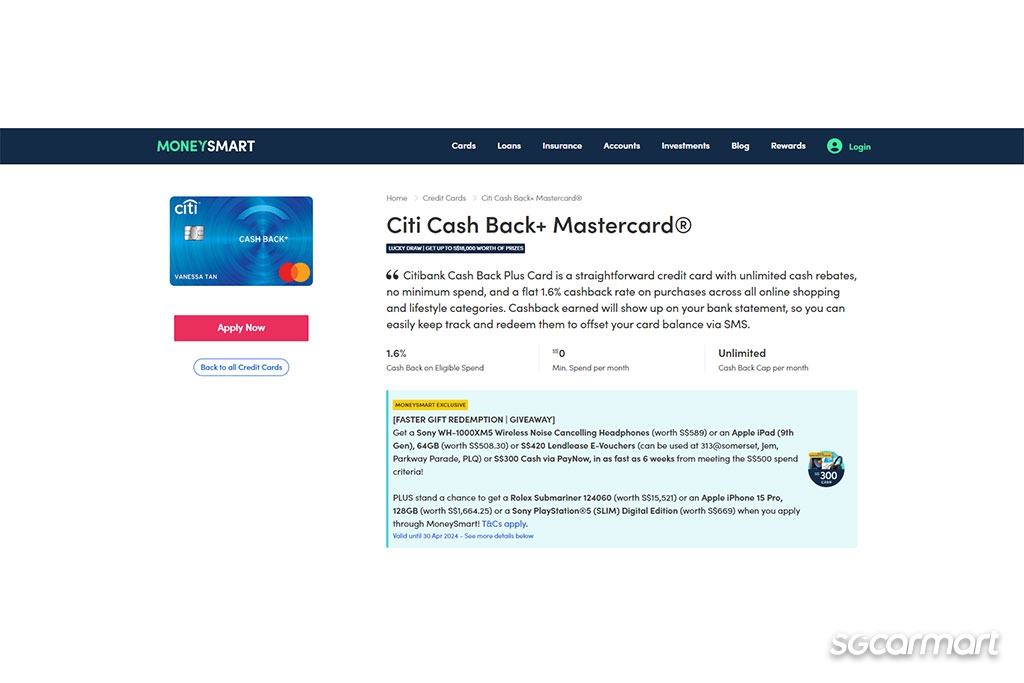

Fire up your browser, step into a bank or even restaurant and you'll likely find advertisements for credit cards offering alluring, almost too-good-to-be-true bonuses that stare out at you. Unlimited cashback on your biggest lifestyle categories here! Redeem an Apple iPad worth half a thousand dollars over there!

What these time-limited promotions do is make us feel rushed, so we waste no time in hopping on the bandwagon.

Each time we apply for a credit card, we open a new inquiry in our credit report (even if we don't actually see it). The more inquiries opened within a short period of time, the riskier one appears to lenders. In turn, this affects your ability to apply for loans or credit since you're assessed to be a credit risk.

As a best practice, apply for credit only when necessary. Experts also suggest limiting it to at most once every six months.

Yet if you must - perhaps owing to the irresistible deals on the table - first perform a robustness check by considering these areas before going ahead with your application:

• Does the card offer a sign-up bonus value that's at least three years of its annual fee?

• Does it serve the practical needs of your lifestyle? Or are you adjusting your lifestyle to what the card offers?

• Are you able to meet the minimum spend requirement?

• How often will your accumulated points expire?

If you're confident of ticking most if not all of the boxes, there's a high chance that the card's truly what you need. Otherwise, stay calm and well, think again.

Stay wise, stay worry-free

As much as the use of credit card(s) has become second nature to us, using it correctly should likewise come naturally to us. For all the effort we've invested in determining the right card for ourselves and building up defences against potential attacks on our wealth, let's not bring it all to naught at this final stage.

It takes just a little caution to stay worry-free when living with credit cards.

Tap your card and go. You may find this series of actions familiar, and maybe that's because you perform them every day, multiple times.

We tap to pay for our morning coffee fix, grocery runs, and for the non-drivers, public transport commutes. Rinse, repeat this periodically at the petrol stations for those who drive.

We're talking about making payments with our credit card. There's no two ways about completing transactions using credit cards. But there are scenarios that can put you at a disadvantage if you're not wise with handling it.

Some of these unconscious, self-penalising moments could manifest as instances of repeated fare charges or a taint on your credit score.

Practising secure measures on using credit card(s) gives you a strong start against cyber criminals. Now here are some complementary practices, which you could dish out conscientiously, to fortify your wealth.

Same credit card, multiple fare charges..?

Have you ever encountered situations where you paid more for your train or bus ride than you ought to? You may even have wondered if you had, in a flurry of activity to break free from the bottleneck at the fare gantries, double tapped your card.

Same same but different? Tapping in and out of public transport rides using the same card but on different modes will incur you different fares

More frequently than you might think, though, the reason could be due to the seemingly innocuous act of tapping in and out with different methods.

So what counts as a payment method? According to the Land Transport Authority (LTA), these include digital wallets in smartphones, physical credit/debit cards, and smart watches. The important thing to remember is that while these are one with the credit card you own - whether they exist physically or in a virtual form - they aren't the same. Not to the card readers, at least.

This means that if you were to tap in using your credit card then tap out with your smart watch, you will be charged twice the fare you should be paying for your ride. For some reason since systems have not caught up with the technological advances in the accessories we use, we'll have to adapt by adjusting our behaviours.

Whatever you use to tap in, make sure you tap out using the same method.

One less card means one more worry

You might be sitting on a decision to cancel a stack of cards, which you can't seem to all fit in your wallet or cardholder. But it will do you even more good to do some homework before you proceed.

A question you should consider when you're at such a crossroads is: How long have you had your credit card for? Simply because the average length of time you've had credit affects your credit score.

If you own two credit cards, one that's 10 years old and another that's four years old, you have an average of seven years of credit. If you decide to close the 10-year-old card, your credit age then falls to four years.

In short, a longer credit history makes you more credit-worthy and that translates to a better credit score. This also means, the longer you've held on to a credit card improves your score.

There's a good reason for why you shouldn't cancel a credit card even when you don't use it. Doing so potentially reduces your credit score instead of raising it, consumer finance analyst for U.S. News & World Report, Beverly Harzog, told Investopedia.

Closing a credit card account can affect your credit utilisation ratio, a measure of the percentage of credits you have available that's being used. The more available credits used, the higher your credit utilisation ratio will be. This can negatively impact your credit score especially if you cancel a card without having paid your balance in full.

The takeaway here is to exercise judgement when deciding whether or not to cancel a credit card. Even if the impetus may be to avoid excessive spending, declutter your cards, or to protect yourself from the risk of identity theft when you misplace one.

Don't be greedy to sign up for cards

But perhaps the best way to steer clear of the conundrum we've just discussed is simply to be less greedy for credit cards.

Fire up your browser, step into a bank or even restaurant and you'll likely find advertisements for credit cards offering alluring, almost too-good-to-be-true bonuses that stare out at you. Unlimited cashback on your biggest lifestyle categories here! Redeem an Apple iPad worth half a thousand dollars over there!

What these time-limited promotions do is make us feel rushed, so we waste no time in hopping on the bandwagon.

Each time we apply for a credit card, we open a new inquiry in our credit report (even if we don't actually see it). The more inquiries opened within a short period of time, the riskier one appears to lenders. In turn, this affects your ability to apply for loans or credit since you're assessed to be a credit risk.

As a best practice, apply for credit only when necessary. Experts also suggest limiting it to at most once every six months.

Yet if you must - perhaps owing to the irresistible deals on the table - first perform a robustness check by considering these areas before going ahead with your application:

• Does the card offer a sign-up bonus value that's at least three years of its annual fee?

• Does it serve the practical needs of your lifestyle? Or are you adjusting your lifestyle to what the card offers?

• Are you able to meet the minimum spend requirement?

• How often will your accumulated points expire?

If you're confident of ticking most if not all of the boxes, there's a high chance that the card's truly what you need. Otherwise, stay calm and well, think again.

Stay wise, stay worry-free

As much as the use of credit card(s) has become second nature to us, using it correctly should likewise come naturally to us. For all the effort we've invested in determining the right card for ourselves and building up defences against potential attacks on our wealth, let's not bring it all to naught at this final stage.

It takes just a little caution to stay worry-free when living with credit cards.

Thank You For Your Subscription.