Car depreciation - Here's all you need to know

12 Dec 2020|134,410 views

Depreciation is defined as 'the reduction in the value of an asset over time'.

Cars in Singapore are notoriously expensive, yes. However, what actually makes it so 'expensive' is the fact that any car's value reduces significantly over a 10 year period - i.e. high depreciation.

If you in fact buy a car for $100,000, and then sell it off after 10 years for $90,000, you probably wouldn't then consider it to be really expensive, considering you only lose $10,000 in value over 10 years. However, in Singapore you can easily be looking at a depreciation value of $10,000 a year for a brand new car.

Depreciation and your car's 'value'

Therefore, a car's depreciation figure is often equated to its so-called value. Simply put, for most people, a 'low-depre car' is considered more financially worthwhile to own over a 'high-depre' car.

But, how do you calculate the depreciation of a vehicle? You start by understanding the deregistration value of your car.

Deregistration value of your car

Put simply, the deregistration value of a vehicle is how much money you will get back when you deregister a vehicle. It is often also referred to as 'paper value'.

First, there are a few terms that need defining and explaining. The Additional Registration Fee (ARF) is a tax that is imposed on all cars, as is calculated as a percentage of a vehicles Open Market Value (OMV) using the following formula:

| Vehicle OMV | ARF Rate (% of OMV to pay) |

| First $20,000 | 100% |

| Next $20,000 (i.e. $20,001 to $40,000) | 140% |

| Next $20,000 (i.e. $40,001 to $60,000) | 190% |

| Next $20,000 (i.e. $60,001 to $80,000) | 250% |

| Above $80,000 | 320% |

Worth noting is that the ARF system was heavily revised in February 2023 in line with efforts to implement more progressive vehicle taxes in the local car market.

If you deregister your vehicle within the first 10 years, you are entitled to a Preferential Additional Registration Fee (PARF) rebate, based off a percentage of your ARF value.

However, the level of rebates one can now enjoy when deregistering the aforementioned group of ultra-luxury cars has also been reduced, with a hard ceiling of $60,000 imposed on the amount one can get back.

| Age of vehicle at deregistration | PARF rebate (COE Feb 2023 onwards) |

| Not exceeding expectations 5 years | 75% of ARF paid, capped at $60,000 |

| Above 5 years but not exceeding 6 years | 70% of ARF paid, capped at $60,000 |

| Above 6 years but not exceeding 7 years | 65% of ARF paid, capped at $60,000 |

| Above 7 years but not exceeding 8 years | 60% of ARF paid, capped at $60,000 |

| Above 8 years but not exceeding 9 years | 55% of ARF paid, capped at $60,000 |

| Above 9 years but not exceeding 10 years | 50% of ARF paid, capped at $60,000 |

| Above 10 years | NA |

For cars older than 10 years (meaning cars with renewed COEs), you will not receive any PARF rebate when the vehicle is deregistered.

Additionally, when you deregister your vehicle, you may also receive a COE rebate. This is basically a rebate for the unused duration of your vehicle's COE. It is calculated as such:

COE rebate = [Quota Premium Paid x Number of months left] / 120 months

A vehicle's deregistration value is thus the sum of the PARF and COE rebates.

Deregistration value = [COE rebate + PARF rebate]

How to calculate car depreciation

Annual depreciation = [Sales price – Deregistration value] / Remaining years of COE

Do expensive cars mean high depreciation?

Generally speaking, more expensive cars tend to have higher depreciation values, but not always. A higher sales price does not necessarily mean a higher depreciation value.

For example, a brand new Car A costs $100,000, and has a deregistration value of $9,000. Therefore, the annual depreciation is [$100,000 - $9,000] / 10 = $9,100.

A brand new Car B costs $110,000, but has a deregistration value of $20,000. Its annual depreciation would be [$110,000 - $20,000] / 10 = $9,000.

Depreciation for a used car

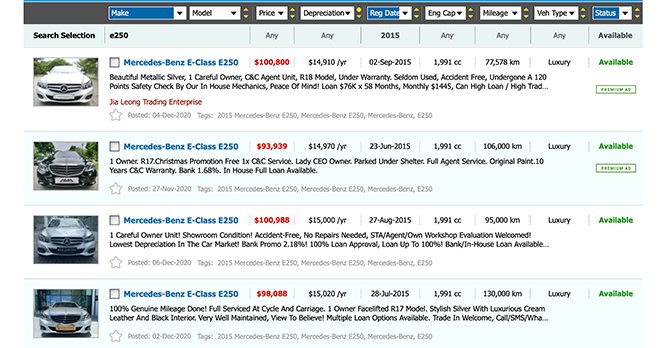

Of course, when you start to get into the used car market, depreciation values can vary significantly. All three variables can be different - depending on how sellers price their vehicles, the OMV of the car, and how many years of COE a vehicle has left.

For example, on Sgcarmart's Used Car listings, you can find used 2015 Mercedes-Benz C200 Sedan models with annual depreciation ranging from $23,120/year to $23,820/year. (Exact prices fluctuate regularly depending on market conditions.)

For COE cars, since there is no deregistration value, the depreciation of the car is simply [selling price / remaining years of COE].

*This article was last updated by the Editorial Team on 7 March 2023.

Here are some articles you might be interested in

How Budget 2023 will affect the ARFs of new cars: A sample of 23 models

6 things to note before you renew your COE for five or 10 years

COE Renewal: 10 Things you wish you knew

Want to buy a used car in Singapore? Do a proper vehicle evaluation first!

What makes cars so expensive in Singapore?

You need to avoid these 5 car buying mistakes at all costs!

Sgcarmart Quotz

Sell your Car for the Best Price

Simply Sell Your Car for MORE!

- Auction to 500+ dealers

- Confirmed price, No reductions

Depreciation is defined as 'the reduction in the value of an asset over time'.

Cars in Singapore are notoriously expensive, yes. However, what actually makes it so 'expensive' is the fact that any car's value reduces significantly over a 10 year period - i.e. high depreciation.

If you in fact buy a car for $100,000, and then sell it off after 10 years for $90,000, you probably wouldn't then consider it to be really expensive, considering you only lose $10,000 in value over 10 years. However, in Singapore you can easily be looking at a depreciation value of $10,000 a year for a brand new car.

Depreciation and your car's 'value'

Therefore, a car's depreciation figure is often equated to its so-called value. Simply put, for most people, a 'low-depre car' is considered more financially worthwhile to own over a 'high-depre' car.

But, how do you calculate the depreciation of a vehicle? You start by understanding the deregistration value of your car.

Deregistration value of your car

Put simply, the deregistration value of a vehicle is how much money you will get back when you deregister a vehicle. It is often also referred to as 'paper value'.

First, there are a few terms that need defining and explaining. The Additional Registration Fee (ARF) is a tax that is imposed on all cars, as is calculated as a percentage of a vehicles Open Market Value (OMV) using the following formula:

| Vehicle OMV | ARF Rate (% of OMV to pay) |

| First $20,000 | 100% |

| Next $20,000 (i.e. $20,001 to $40,000) | 140% |

| Next $20,000 (i.e. $40,001 to $60,000) | 190% |

| Next $20,000 (i.e. $60,001 to $80,000) | 250% |

| Above $80,000 | 320% |

If you deregister your vehicle within the first 10 years, you are entitled to a Preferential Additional Registration Fee (PARF) rebate, based off a percentage of your ARF value.

However, the level of rebates one can now enjoy when deregistering the aforementioned group of ultra-luxury cars has also been reduced, with a hard ceiling of $60,000 imposed on the amount one can get back.

| Age of vehicle at deregistration | PARF rebate (COE Feb 2023 onwards) |

| Not exceeding expectations 5 years | 75% of ARF paid, capped at $60,000 |

| Above 5 years but not exceeding 6 years | 70% of ARF paid, capped at $60,000 |

| Above 6 years but not exceeding 7 years | 65% of ARF paid, capped at $60,000 |

| Above 7 years but not exceeding 8 years | 60% of ARF paid, capped at $60,000 |

| Above 8 years but not exceeding 9 years | 55% of ARF paid, capped at $60,000 |

| Above 9 years but not exceeding 10 years | 50% of ARF paid, capped at $60,000 |

| Above 10 years | NA |

Additionally, when you deregister your vehicle, you may also receive a COE rebate. This is basically a rebate for the unused duration of your vehicle's COE. It is calculated as such:

COE rebate = [Quota Premium Paid x Number of months left] / 120 months

A vehicle's deregistration value is thus the sum of the PARF and COE rebates.

Deregistration value = [COE rebate + PARF rebate]

How to calculate car depreciation

Annual depreciation = [Sales price – Deregistration value] / Remaining years of COE

Do expensive cars mean high depreciation?

Generally speaking, more expensive cars tend to have higher depreciation values, but not always. A higher sales price does not necessarily mean a higher depreciation value.

For example, a brand new Car A costs $100,000, and has a deregistration value of $9,000. Therefore, the annual depreciation is [$100,000 - $9,000] / 10 = $9,100.

A brand new Car B costs $110,000, but has a deregistration value of $20,000. Its annual depreciation would be [$110,000 - $20,000] / 10 = $9,000.

Depreciation for a used car

Of course, when you start to get into the used car market, depreciation values can vary significantly. All three variables can be different - depending on how sellers price their vehicles, the OMV of the car, and how many years of COE a vehicle has left.

For example, on Sgcarmart's Used Car listings, you can find used 2015 Mercedes-Benz C200 Sedan models with annual depreciation ranging from $23,120/year to $23,820/year. (Exact prices fluctuate regularly depending on market conditions.)

For COE cars, since there is no deregistration value, the depreciation of the car is simply [selling price / remaining years of COE].

*This article was last updated by the Editorial Team on 7 March 2023.

Here are some articles you might be interested in

How Budget 2023 will affect the ARFs of new cars: A sample of 23 models

6 things to note before you renew your COE for five or 10 years

COE Renewal: 10 Things you wish you knew

Want to buy a used car in Singapore? Do a proper vehicle evaluation first!

What makes cars so expensive in Singapore?

You need to avoid these 5 car buying mistakes at all costs!

Sgcarmart Quotz

Sell your Car for the Best Price

Simply Sell Your Car for MORE!

- Auction to 500+ dealers

- Confirmed price, No reductions