Calculate your car loan interest for early settlement using Rule of 78

17 Oct 2007|375,803 views

Car loans cannot be transferred from one party to another. Therefore, when an owner sells his car, he will need to fully pay off the loan before the ownership transfer. Car buyers usually finance their purchase with a loan of five years or longer, but because most of them will sell their cars before that, early redemption of car loan is commonplace.

Early redemption amount for car loans in Singapore is calculated based on the Rule of 78, which is a method of allocating the interest charge on a loan across its payment periods. More interest charge is allocated to earlier payments compared to the later ones. Because of this, paying off a loan early will result in the borrower paying more interest overall.

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.

When doing an early redemption on a car loan, the amount to pay is:

Initial loan amount + total interest - instalments already paid - 80 percent of unpaid interest

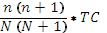

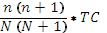

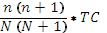

Now, the formula for Rule of 78

Whereby:

Early redemption amount for car loans in Singapore is calculated based on the Rule of 78, which is a method of allocating the interest charge on a loan across its payment periods. More interest charge is allocated to earlier payments compared to the later ones. Because of this, paying off a loan early will result in the borrower paying more interest overall.

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.

When doing an early redemption on a car loan, the amount to pay is:

Initial loan amount + total interest - instalments already paid - 80 percent of unpaid interest

Now, the formula for Rule of 78

| R = |  |

Whereby:

| R | represents the unpaid interest |

| n | represents the balance loan period expressed in months |

| N | represents the original loan period expressed in months |

| TC | represents the total amount of interest payable over the loan period |

Let's use an example to illustrate the formula.

Let's say you have a five-year loan of $50,000 at three percent interest that you wish to fully pay up after 20 months. Assuming the bank uses the Rule of 78 to calculate the interest rebate, with a 20 percent penalty on the rebate for early repayment.

Loan amount = $50,000

Interest rate = 3% per annum

Total interest to be paid = (3% x 5 years x $50,000) = $7,500

Period of finance = 60 months or 5 years

Monthly instalment = ($50,000 + $7,500) / 60 = $958.33

Number of instalments paid = 20 months

Total amount already paid for = $958.33 x 20 = $19,166.67

Unpaid interest according to Rule of 78 = [40(40+1)] / [60(60+1)] x $7,500 = $3,360.66

Here, 40 represents the number of months remaining of the bank loan that is unpaid, and 60 is the original number of months of the bank loan. The amount of $3,360.66 is the unpaid interest on the 40 months from early termination of the loan.

80% of unpaid interest = 0.8 x $3,360.66 = $2,688.52

Loan redemption amount = $50,000 + $7,500 - $19,166.67 - $2,688.52 = $35,644.81

That is, initial loan amount ($50,000) plus total interest ($7,500), deducting the instalment amounts already paid for ($19,166.67), deducting the 80 percent of unpaid interest ($2,688.52), resulting in the loan redemption amount ($35,644.81).

In the event that you do buy a car from a direct seller or simply want to keep your financing options open, sgCarMart Connect - Singapore's first one-stop auto transaction service - can help you apply for a loan and motor insurance from at least five financial institutions. In addition, Connect will help the seller settle his or her outstanding loan, apply for an insurance refund and draft legal documentation for both parties - all for free. sgCarMart Connect can be contacted at 6744 3540.

Here are some related articles that might interest you

Rule of 78 - Everything you need to know

A comparison of the five most popular banks and financial institutes for car loans

Vehicle dollars and sense - A guide to car loans

Renewing the COE of your car might be a fatal error! Here's why

We provide transactional services for direct buyer and seller deals. All paperwork done by us so you don't have to! FREE for all cars listed on sgCarMart.

*This article was updated on the 17th April 2018.

Let's say you have a five-year loan of $50,000 at three percent interest that you wish to fully pay up after 20 months. Assuming the bank uses the Rule of 78 to calculate the interest rebate, with a 20 percent penalty on the rebate for early repayment.

Loan amount = $50,000

Interest rate = 3% per annum

Total interest to be paid = (3% x 5 years x $50,000) = $7,500

Period of finance = 60 months or 5 years

Monthly instalment = ($50,000 + $7,500) / 60 = $958.33

Number of instalments paid = 20 months

Total amount already paid for = $958.33 x 20 = $19,166.67

Unpaid interest according to Rule of 78 = [40(40+1)] / [60(60+1)] x $7,500 = $3,360.66

Here, 40 represents the number of months remaining of the bank loan that is unpaid, and 60 is the original number of months of the bank loan. The amount of $3,360.66 is the unpaid interest on the 40 months from early termination of the loan.

80% of unpaid interest = 0.8 x $3,360.66 = $2,688.52

Loan redemption amount = $50,000 + $7,500 - $19,166.67 - $2,688.52 = $35,644.81

That is, initial loan amount ($50,000) plus total interest ($7,500), deducting the instalment amounts already paid for ($19,166.67), deducting the 80 percent of unpaid interest ($2,688.52), resulting in the loan redemption amount ($35,644.81).

In the event that you do buy a car from a direct seller or simply want to keep your financing options open, sgCarMart Connect - Singapore's first one-stop auto transaction service - can help you apply for a loan and motor insurance from at least five financial institutions. In addition, Connect will help the seller settle his or her outstanding loan, apply for an insurance refund and draft legal documentation for both parties - all for free. sgCarMart Connect can be contacted at 6744 3540.

Here are some related articles that might interest you

Rule of 78 - Everything you need to know

A comparison of the five most popular banks and financial institutes for car loans

Vehicle dollars and sense - A guide to car loans

Renewing the COE of your car might be a fatal error! Here's why

We provide transactional services for direct buyer and seller deals. All paperwork done by us so you don't have to! FREE for all cars listed on sgCarMart.

Sgcarmart

List your Car on Sgcarmart

Post an ad for your car. Sell it directly for the best price.

- Get your car listed until it is sold!

- We provide free paperwork support for your transaction

*This article was updated on the 17th April 2018.

Car loans cannot be transferred from one party to another. Therefore, when an owner sells his car, he will need to fully pay off the loan before the ownership transfer. Car buyers usually finance their purchase with a loan of five years or longer, but because most of them will sell their cars before that, early redemption of car loan is commonplace.

Early redemption amount for car loans in Singapore is calculated based on the Rule of 78, which is a method of allocating the interest charge on a loan across its payment periods. More interest charge is allocated to earlier payments compared to the later ones. Because of this, paying off a loan early will result in the borrower paying more interest overall.

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.

When doing an early redemption on a car loan, the amount to pay is:

Initial loan amount + total interest - instalments already paid - 80 percent of unpaid interest

Now, the formula for Rule of 78

Whereby:

Early redemption amount for car loans in Singapore is calculated based on the Rule of 78, which is a method of allocating the interest charge on a loan across its payment periods. More interest charge is allocated to earlier payments compared to the later ones. Because of this, paying off a loan early will result in the borrower paying more interest overall.

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.

When doing an early redemption on a car loan, the amount to pay is:

Initial loan amount + total interest - instalments already paid - 80 percent of unpaid interest

Now, the formula for Rule of 78

| R | represents the unpaid interest |

| n | represents the balance loan period expressed in months |

| N | represents the original loan period expressed in months |

| TC | represents the total amount of interest payable over the loan period |

Let's use an example to illustrate the formula.

Let's say you have a five-year loan of $50,000 at three percent interest that you wish to fully pay up after 20 months. Assuming the bank uses the Rule of 78 to calculate the interest rebate, with a 20 percent penalty on the rebate for early repayment.

Loan amount = $50,000

Interest rate = 3% per annum

Total interest to be paid = (3% x 5 years x $50,000) = $7,500

Period of finance = 60 months or 5 years

Monthly instalment = ($50,000 + $7,500) / 60 = $958.33

Number of instalments paid = 20 months

Total amount already paid for = $958.33 x 20 = $19,166.67

Unpaid interest according to Rule of 78 = [40(40+1)] / [60(60+1)] x $7,500 = $3,360.66

Here, 40 represents the number of months remaining of the bank loan that is unpaid, and 60 is the original number of months of the bank loan. The amount of $3,360.66 is the unpaid interest on the 40 months from early termination of the loan.

80% of unpaid interest = 0.8 x $3,360.66 = $2,688.52

Loan redemption amount = $50,000 + $7,500 - $19,166.67 - $2,688.52 = $35,644.81

That is, initial loan amount ($50,000) plus total interest ($7,500), deducting the instalment amounts already paid for ($19,166.67), deducting the 80 percent of unpaid interest ($2,688.52), resulting in the loan redemption amount ($35,644.81).

In the event that you do buy a car from a direct seller or simply want to keep your financing options open, sgCarMart Connect - Singapore's first one-stop auto transaction service - can help you apply for a loan and motor insurance from at least five financial institutions. In addition, Connect will help the seller settle his or her outstanding loan, apply for an insurance refund and draft legal documentation for both parties - all for free. sgCarMart Connect can be contacted at 6744 3540.

Here are some related articles that might interest you

Rule of 78 - Everything you need to know

A comparison of the five most popular banks and financial institutes for car loans

Vehicle dollars and sense - A guide to car loans

Renewing the COE of your car might be a fatal error! Here's why

We provide transactional services for direct buyer and seller deals. All paperwork done by us so you don't have to! FREE for all cars listed on sgCarMart.

*This article was updated on the 17th April 2018.

Let's say you have a five-year loan of $50,000 at three percent interest that you wish to fully pay up after 20 months. Assuming the bank uses the Rule of 78 to calculate the interest rebate, with a 20 percent penalty on the rebate for early repayment.

Loan amount = $50,000

Interest rate = 3% per annum

Total interest to be paid = (3% x 5 years x $50,000) = $7,500

Period of finance = 60 months or 5 years

Monthly instalment = ($50,000 + $7,500) / 60 = $958.33

Number of instalments paid = 20 months

Total amount already paid for = $958.33 x 20 = $19,166.67

Unpaid interest according to Rule of 78 = [40(40+1)] / [60(60+1)] x $7,500 = $3,360.66

Here, 40 represents the number of months remaining of the bank loan that is unpaid, and 60 is the original number of months of the bank loan. The amount of $3,360.66 is the unpaid interest on the 40 months from early termination of the loan.

80% of unpaid interest = 0.8 x $3,360.66 = $2,688.52

Loan redemption amount = $50,000 + $7,500 - $19,166.67 - $2,688.52 = $35,644.81

That is, initial loan amount ($50,000) plus total interest ($7,500), deducting the instalment amounts already paid for ($19,166.67), deducting the 80 percent of unpaid interest ($2,688.52), resulting in the loan redemption amount ($35,644.81).

In the event that you do buy a car from a direct seller or simply want to keep your financing options open, sgCarMart Connect - Singapore's first one-stop auto transaction service - can help you apply for a loan and motor insurance from at least five financial institutions. In addition, Connect will help the seller settle his or her outstanding loan, apply for an insurance refund and draft legal documentation for both parties - all for free. sgCarMart Connect can be contacted at 6744 3540.

Here are some related articles that might interest you

Rule of 78 - Everything you need to know

A comparison of the five most popular banks and financial institutes for car loans

Vehicle dollars and sense - A guide to car loans

Renewing the COE of your car might be a fatal error! Here's why

We provide transactional services for direct buyer and seller deals. All paperwork done by us so you don't have to! FREE for all cars listed on sgCarMart.

Sgcarmart

List your Car on Sgcarmart

Post an ad for your car. Sell it directly for the best price.

- Get your car listed until it is sold!

- We provide free paperwork support for your transaction

*This article was updated on the 17th April 2018.