March 2023: COE supply projected to fall uniformly, even as Cat A, B and E premiums all stand at record highs

31 Mar 2023|46,726 views

COE price trend over the past quarter: January to March 2023 vs October to December 2022

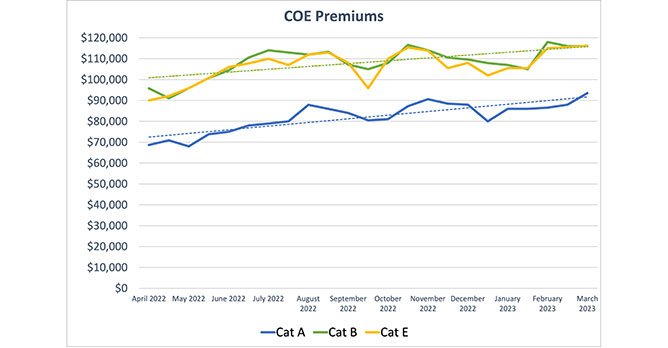

We asked if the worst was over when we wrote our previous analysis - with the slight glimmer of hope emanating from two observations. Firstly, COE premiums were appearing to level out back in December 2022. Secondly, a slight COE supply increase had also been projected.

How wrong we were. In the second COE bidding round of March (and the latest so far), all categories broke their past records.

Category A now stands at $93,503 (the previous peak was $92,100 in early 2013); Category B, at $116,201; and Category E, at $116,020.

To be fair, it's not that the situation worsened continuously; premiums for the passenger car categories actually slid in January and early February.

On that note, because of this mixture of downwards and upwards movement, COE premiums - when averaged out across the months of January to March 2023 - do not appear very much steeper than across October to December last year. The percentage changes in prices across Category A, B and E thus wind up at a 0.8%, 1.7% and 0.9% increase respectively.

Beneath these numbers, there's quite a fair bit to unpack regarding in terms of what has happened between now and the start of 2023.

For starters, as it revealed the COE supply for the February to April 2023 period, the LTA also announced that it was tweaking the quota calculation method.

Instead of basing the number of COEs available for bidding in each quarter of a rolling average of de-registrations from the previous six months (two quarters), it now takes de-registrations from the entirety of the previous year (four quarters). The change marked the second amendment the LTA had made to its calculation methodology in just under a year.

Conceptualised to reduce COE supply volatility, this should have taken the pressure of climbing premiums. But a couple of other (likely) conflicting forces were at play.

Spikes in showroom traffic and sales for larger cars were noted after the ARF revisions were confirmed One of them - the 2023 Singapore Motor Show - was out of the LTA's hands, as dealers pulled out new car launches and the best deals over the second weekend of January.

Spikes in showroom traffic and sales for larger cars were noted after the ARF revisions were confirmed One of them - the 2023 Singapore Motor Show - was out of the LTA's hands, as dealers pulled out new car launches and the best deals over the second weekend of January.

The other, as we all know, was a revision to the Additional Registration Fee (ARF) taxation system following Budget 2023 (in mid-February), which impacted cars with an Open Market Value (OMV) of above $40,000.

News broke soon after that open Category COEs (Cat E) from earlier tenders were being traded at a premium so that luxury car buyers could sidestep the higher taxes. Showroom traffic, and sales for larger cars, were also reported to have received a bump after the ARF revision.

Nonetheless, the market appears to be suffering on the whole, with both new car registrations and used car sales falling in the first two months of 2023.

Vehicle de-registration and COE supply forecasting

Because we relied on the LTA's previous calculation methodology for our December 2022 COE analysis, it isn't surprising that that particular forecast underestimated the rises in COE supply across all passenger categories for the February to April 2023 period.

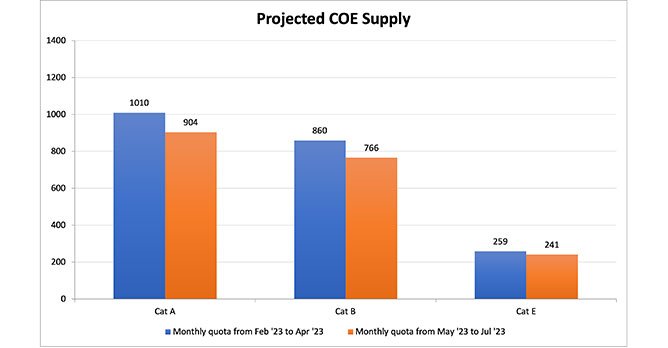

We are, however, back on track with the LTA's latest calculation methodology now. And even so - with this 'stabler' approach - data extrapolated from de-registrations between April 2022 to February 2023 suggests that COE supply is set to fall quite notably for the May to July 2023 quota period: By approximately 10%.

Cat B is set for the sharpest dip, with the quota falling by around 11% from the current monthly average of 860. But Cat A isn't too far behind either, for which the COE quota is set to slide 10% from the current monthly average of 1010.

Things are marginally better in the open Cat E, for which the COE quota has been forecast to decline by 7% from the current monthly average of 259.

If there's anything to take away from these numbers, it is the possibility that all-time records have yet to be inked. What may provide some reprieve is the fact that new car launches have slowed since the blitzkrieg of unveilings at the Motor Show - although we might also want to beware that the group of EVs eligible for a Cat A COE has been slowly growing recently.

New car pricing: January to March 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Nonetheless, an interesting (and growing) phenomenon to note is that some dealers are opting to formulate their pricelists without the COE already factored in, likely to shield themselves from the volatility seen in the market recently.

We've taken the chance to update our pool of cars to also reflect the latest popular cars to hit the market - EVs included.

The facelifted Palisade is now retailing for nearly $100,000 more than when the original model launched in 2021 Based on our sample, there was a steeper 2.6% increase quarter-on-quarter increase in new car prices over the past quarter when compared to the previous tri-monthly average between October to December 2022.

The facelifted Palisade is now retailing for nearly $100,000 more than when the original model launched in 2021 Based on our sample, there was a steeper 2.6% increase quarter-on-quarter increase in new car prices over the past quarter when compared to the previous tri-monthly average between October to December 2022.

As for what this means in terms of how our new cars are being priced, it appears most of our dealers are still simply following COE price trends. Worth nothing is that the 2.6% figure represents double the rate of increase seen for the previous period.

On the one hand, this is still nowhere near the consistently sharp spikes we saw in 2021 (12% is the highest we've noted on record).

On the other hand, however, it's also alarming to think that cars can still become more expensive. For instance, the recently facelifted Hyundai Palisade retails for around $300,000 now; it was in the low $200,000s back when the car first reached us in early 2021.

Most popular used cars: December 2022 to February 2023

Over the three-month period between December 2022 to February 2023, these were the five most listed used cars on Sgcarmart.

An interesting point to note is that even though the three-month average for our evergreen yardstick, the Honda Vezel, has once again increased, used car prices appeared to respond to the momentary COE dips seen in this period.

Average annual depreciation figures for the Vezel, for instance, were lower in December and January than they were in November last year. Nonetheless, as COE prices have continued to climb again, the annual depreciation for the Vezel is now slowly approaching $15,000. For context, you'll see this figure on brand new cars like the Yaris Cross Hybrid.

Other notable models that made a splash on our listings over the last three months include the previous generation Mazda 3 1.5A Sedan, BMW X1 sDrive18i, and Nissan Qashqai 1.2A DIG-T, all registered in 2017.

Curious about what we had to say in our previous forecasts? Here's a look back on our previous three COE analyses!

December 2022: As premiums stabilise slightly, COE supply for Cat A and E projected to increase slightly in Feb

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

We asked if the worst was over when we wrote our previous analysis - with the slight glimmer of hope emanating from two observations. Firstly, COE premiums were appearing to level out back in December 2022. Secondly, a slight COE supply increase had also been projected.

How wrong we were. In the second COE bidding round of March (and the latest so far), all categories broke their past records.

Category A now stands at $93,503 (the previous peak was $92,100 in early 2013); Category B, at $116,201; and Category E, at $116,020.

To be fair, it's not that the situation worsened continuously; premiums for the passenger car categories actually slid in January and early February.

On that note, because of this mixture of downwards and upwards movement, COE premiums - when averaged out across the months of January to March 2023 - do not appear very much steeper than across October to December last year. The percentage changes in prices across Category A, B and E thus wind up at a 0.8%, 1.7% and 0.9% increase respectively.

Beneath these numbers, there's quite a fair bit to unpack regarding in terms of what has happened between now and the start of 2023.

For starters, as it revealed the COE supply for the February to April 2023 period, the LTA also announced that it was tweaking the quota calculation method.

Instead of basing the number of COEs available for bidding in each quarter of a rolling average of de-registrations from the previous six months (two quarters), it now takes de-registrations from the entirety of the previous year (four quarters). The change marked the second amendment the LTA had made to its calculation methodology in just under a year.

Conceptualised to reduce COE supply volatility, this should have taken the pressure of climbing premiums. But a couple of other (likely) conflicting forces were at play.

The other, as we all know, was a revision to the Additional Registration Fee (ARF) taxation system following Budget 2023 (in mid-February), which impacted cars with an Open Market Value (OMV) of above $40,000.

News broke soon after that open Category COEs (Cat E) from earlier tenders were being traded at a premium so that luxury car buyers could sidestep the higher taxes. Showroom traffic, and sales for larger cars, were also reported to have received a bump after the ARF revision.

Nonetheless, the market appears to be suffering on the whole, with both new car registrations and used car sales falling in the first two months of 2023.

Vehicle de-registration and COE supply forecasting

Because we relied on the LTA's previous calculation methodology for our December 2022 COE analysis, it isn't surprising that that particular forecast underestimated the rises in COE supply across all passenger categories for the February to April 2023 period.

We are, however, back on track with the LTA's latest calculation methodology now. And even so - with this 'stabler' approach - data extrapolated from de-registrations between April 2022 to February 2023 suggests that COE supply is set to fall quite notably for the May to July 2023 quota period: By approximately 10%.

Cat B is set for the sharpest dip, with the quota falling by around 11% from the current monthly average of 860. But Cat A isn't too far behind either, for which the COE quota is set to slide 10% from the current monthly average of 1010.

Things are marginally better in the open Cat E, for which the COE quota has been forecast to decline by 7% from the current monthly average of 259.

If there's anything to take away from these numbers, it is the possibility that all-time records have yet to be inked. What may provide some reprieve is the fact that new car launches have slowed since the blitzkrieg of unveilings at the Motor Show - although we might also want to beware that the group of EVs eligible for a Cat A COE has been slowly growing recently.

New car pricing: January to March 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Nonetheless, an interesting (and growing) phenomenon to note is that some dealers are opting to formulate their pricelists without the COE already factored in, likely to shield themselves from the volatility seen in the market recently.

We've taken the chance to update our pool of cars to also reflect the latest popular cars to hit the market - EVs included.

As for what this means in terms of how our new cars are being priced, it appears most of our dealers are still simply following COE price trends. Worth nothing is that the 2.6% figure represents double the rate of increase seen for the previous period.

On the one hand, this is still nowhere near the consistently sharp spikes we saw in 2021 (12% is the highest we've noted on record).

On the other hand, however, it's also alarming to think that cars can still become more expensive. For instance, the recently facelifted Hyundai Palisade retails for around $300,000 now; it was in the low $200,000s back when the car first reached us in early 2021.

Most popular used cars: December 2022 to February 2023

Over the three-month period between December 2022 to February 2023, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,408/yr |

| Honda Civic 1.6A VTi | 2018 | $13,886/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $14,170/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2015 | $21,542/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $20,090/yr |

An interesting point to note is that even though the three-month average for our evergreen yardstick, the Honda Vezel, has once again increased, used car prices appeared to respond to the momentary COE dips seen in this period.

Average annual depreciation figures for the Vezel, for instance, were lower in December and January than they were in November last year. Nonetheless, as COE prices have continued to climb again, the annual depreciation for the Vezel is now slowly approaching $15,000. For context, you'll see this figure on brand new cars like the Yaris Cross Hybrid.

Other notable models that made a splash on our listings over the last three months include the previous generation Mazda 3 1.5A Sedan, BMW X1 sDrive18i, and Nissan Qashqai 1.2A DIG-T, all registered in 2017.

Curious about what we had to say in our previous forecasts? Here's a look back on our previous three COE analyses!

December 2022: As premiums stabilise slightly, COE supply for Cat A and E projected to increase slightly in Feb

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

COE price trend over the past quarter: January to March 2023 vs October to December 2022

We asked if the worst was over when we wrote our previous analysis - with the slight glimmer of hope emanating from two observations. Firstly, COE premiums were appearing to level out back in December 2022. Secondly, a slight COE supply increase had also been projected.

How wrong we were. In the second COE bidding round of March (and the latest so far), all categories broke their past records.

Category A now stands at $93,503 (the previous peak was $92,100 in early 2013); Category B, at $116,201; and Category E, at $116,020.

To be fair, it's not that the situation worsened continuously; premiums for the passenger car categories actually slid in January and early February.

On that note, because of this mixture of downwards and upwards movement, COE premiums - when averaged out across the months of January to March 2023 - do not appear very much steeper than across October to December last year. The percentage changes in prices across Category A, B and E thus wind up at a 0.8%, 1.7% and 0.9% increase respectively.

Beneath these numbers, there's quite a fair bit to unpack regarding in terms of what has happened between now and the start of 2023.

For starters, as it revealed the COE supply for the February to April 2023 period, the LTA also announced that it was tweaking the quota calculation method.

Instead of basing the number of COEs available for bidding in each quarter of a rolling average of de-registrations from the previous six months (two quarters), it now takes de-registrations from the entirety of the previous year (four quarters). The change marked the second amendment the LTA had made to its calculation methodology in just under a year.

Conceptualised to reduce COE supply volatility, this should have taken the pressure of climbing premiums. But a couple of other (likely) conflicting forces were at play.

Spikes in showroom traffic and sales for larger cars were noted after the ARF revisions were confirmed One of them - the 2023 Singapore Motor Show - was out of the LTA's hands, as dealers pulled out new car launches and the best deals over the second weekend of January.

Spikes in showroom traffic and sales for larger cars were noted after the ARF revisions were confirmed One of them - the 2023 Singapore Motor Show - was out of the LTA's hands, as dealers pulled out new car launches and the best deals over the second weekend of January.

The other, as we all know, was a revision to the Additional Registration Fee (ARF) taxation system following Budget 2023 (in mid-February), which impacted cars with an Open Market Value (OMV) of above $40,000.

News broke soon after that open Category COEs (Cat E) from earlier tenders were being traded at a premium so that luxury car buyers could sidestep the higher taxes. Showroom traffic, and sales for larger cars, were also reported to have received a bump after the ARF revision.

Nonetheless, the market appears to be suffering on the whole, with both new car registrations and used car sales falling in the first two months of 2023.

Vehicle de-registration and COE supply forecasting

Because we relied on the LTA's previous calculation methodology for our December 2022 COE analysis, it isn't surprising that that particular forecast underestimated the rises in COE supply across all passenger categories for the February to April 2023 period.

We are, however, back on track with the LTA's latest calculation methodology now. And even so - with this 'stabler' approach - data extrapolated from de-registrations between April 2022 to February 2023 suggests that COE supply is set to fall quite notably for the May to July 2023 quota period: By approximately 10%.

Cat B is set for the sharpest dip, with the quota falling by around 11% from the current monthly average of 860. But Cat A isn't too far behind either, for which the COE quota is set to slide 10% from the current monthly average of 1010.

Things are marginally better in the open Cat E, for which the COE quota has been forecast to decline by 7% from the current monthly average of 259.

If there's anything to take away from these numbers, it is the possibility that all-time records have yet to be inked. What may provide some reprieve is the fact that new car launches have slowed since the blitzkrieg of unveilings at the Motor Show - although we might also want to beware that the group of EVs eligible for a Cat A COE has been slowly growing recently.

New car pricing: January to March 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Nonetheless, an interesting (and growing) phenomenon to note is that some dealers are opting to formulate their pricelists without the COE already factored in, likely to shield themselves from the volatility seen in the market recently.

We've taken the chance to update our pool of cars to also reflect the latest popular cars to hit the market - EVs included.

The facelifted Palisade is now retailing for nearly $100,000 more than when the original model launched in 2021 Based on our sample, there was a steeper 2.6% increase quarter-on-quarter increase in new car prices over the past quarter when compared to the previous tri-monthly average between October to December 2022.

The facelifted Palisade is now retailing for nearly $100,000 more than when the original model launched in 2021 Based on our sample, there was a steeper 2.6% increase quarter-on-quarter increase in new car prices over the past quarter when compared to the previous tri-monthly average between October to December 2022.

As for what this means in terms of how our new cars are being priced, it appears most of our dealers are still simply following COE price trends. Worth nothing is that the 2.6% figure represents double the rate of increase seen for the previous period.

On the one hand, this is still nowhere near the consistently sharp spikes we saw in 2021 (12% is the highest we've noted on record).

On the other hand, however, it's also alarming to think that cars can still become more expensive. For instance, the recently facelifted Hyundai Palisade retails for around $300,000 now; it was in the low $200,000s back when the car first reached us in early 2021.

Most popular used cars: December 2022 to February 2023

Over the three-month period between December 2022 to February 2023, these were the five most listed used cars on Sgcarmart.

An interesting point to note is that even though the three-month average for our evergreen yardstick, the Honda Vezel, has once again increased, used car prices appeared to respond to the momentary COE dips seen in this period.

Average annual depreciation figures for the Vezel, for instance, were lower in December and January than they were in November last year. Nonetheless, as COE prices have continued to climb again, the annual depreciation for the Vezel is now slowly approaching $15,000. For context, you'll see this figure on brand new cars like the Yaris Cross Hybrid.

Other notable models that made a splash on our listings over the last three months include the previous generation Mazda 3 1.5A Sedan, BMW X1 sDrive18i, and Nissan Qashqai 1.2A DIG-T, all registered in 2017.

Curious about what we had to say in our previous forecasts? Here's a look back on our previous three COE analyses!

December 2022: As premiums stabilise slightly, COE supply for Cat A and E projected to increase slightly in Feb

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

We asked if the worst was over when we wrote our previous analysis - with the slight glimmer of hope emanating from two observations. Firstly, COE premiums were appearing to level out back in December 2022. Secondly, a slight COE supply increase had also been projected.

How wrong we were. In the second COE bidding round of March (and the latest so far), all categories broke their past records.

Category A now stands at $93,503 (the previous peak was $92,100 in early 2013); Category B, at $116,201; and Category E, at $116,020.

To be fair, it's not that the situation worsened continuously; premiums for the passenger car categories actually slid in January and early February.

On that note, because of this mixture of downwards and upwards movement, COE premiums - when averaged out across the months of January to March 2023 - do not appear very much steeper than across October to December last year. The percentage changes in prices across Category A, B and E thus wind up at a 0.8%, 1.7% and 0.9% increase respectively.

Beneath these numbers, there's quite a fair bit to unpack regarding in terms of what has happened between now and the start of 2023.

For starters, as it revealed the COE supply for the February to April 2023 period, the LTA also announced that it was tweaking the quota calculation method.

Instead of basing the number of COEs available for bidding in each quarter of a rolling average of de-registrations from the previous six months (two quarters), it now takes de-registrations from the entirety of the previous year (four quarters). The change marked the second amendment the LTA had made to its calculation methodology in just under a year.

Conceptualised to reduce COE supply volatility, this should have taken the pressure of climbing premiums. But a couple of other (likely) conflicting forces were at play.

The other, as we all know, was a revision to the Additional Registration Fee (ARF) taxation system following Budget 2023 (in mid-February), which impacted cars with an Open Market Value (OMV) of above $40,000.

News broke soon after that open Category COEs (Cat E) from earlier tenders were being traded at a premium so that luxury car buyers could sidestep the higher taxes. Showroom traffic, and sales for larger cars, were also reported to have received a bump after the ARF revision.

Nonetheless, the market appears to be suffering on the whole, with both new car registrations and used car sales falling in the first two months of 2023.

Vehicle de-registration and COE supply forecasting

Because we relied on the LTA's previous calculation methodology for our December 2022 COE analysis, it isn't surprising that that particular forecast underestimated the rises in COE supply across all passenger categories for the February to April 2023 period.

We are, however, back on track with the LTA's latest calculation methodology now. And even so - with this 'stabler' approach - data extrapolated from de-registrations between April 2022 to February 2023 suggests that COE supply is set to fall quite notably for the May to July 2023 quota period: By approximately 10%.

Cat B is set for the sharpest dip, with the quota falling by around 11% from the current monthly average of 860. But Cat A isn't too far behind either, for which the COE quota is set to slide 10% from the current monthly average of 1010.

Things are marginally better in the open Cat E, for which the COE quota has been forecast to decline by 7% from the current monthly average of 259.

If there's anything to take away from these numbers, it is the possibility that all-time records have yet to be inked. What may provide some reprieve is the fact that new car launches have slowed since the blitzkrieg of unveilings at the Motor Show - although we might also want to beware that the group of EVs eligible for a Cat A COE has been slowly growing recently.

New car pricing: January to March 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Nonetheless, an interesting (and growing) phenomenon to note is that some dealers are opting to formulate their pricelists without the COE already factored in, likely to shield themselves from the volatility seen in the market recently.

We've taken the chance to update our pool of cars to also reflect the latest popular cars to hit the market - EVs included.

As for what this means in terms of how our new cars are being priced, it appears most of our dealers are still simply following COE price trends. Worth nothing is that the 2.6% figure represents double the rate of increase seen for the previous period.

On the one hand, this is still nowhere near the consistently sharp spikes we saw in 2021 (12% is the highest we've noted on record).

On the other hand, however, it's also alarming to think that cars can still become more expensive. For instance, the recently facelifted Hyundai Palisade retails for around $300,000 now; it was in the low $200,000s back when the car first reached us in early 2021.

Most popular used cars: December 2022 to February 2023

Over the three-month period between December 2022 to February 2023, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,408/yr |

| Honda Civic 1.6A VTi | 2018 | $13,886/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $14,170/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2015 | $21,542/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $20,090/yr |

An interesting point to note is that even though the three-month average for our evergreen yardstick, the Honda Vezel, has once again increased, used car prices appeared to respond to the momentary COE dips seen in this period.

Average annual depreciation figures for the Vezel, for instance, were lower in December and January than they were in November last year. Nonetheless, as COE prices have continued to climb again, the annual depreciation for the Vezel is now slowly approaching $15,000. For context, you'll see this figure on brand new cars like the Yaris Cross Hybrid.

Other notable models that made a splash on our listings over the last three months include the previous generation Mazda 3 1.5A Sedan, BMW X1 sDrive18i, and Nissan Qashqai 1.2A DIG-T, all registered in 2017.

Curious about what we had to say in our previous forecasts? Here's a look back on our previous three COE analyses!

December 2022: As premiums stabilise slightly, COE supply for Cat A and E projected to increase slightly in Feb

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

Thank You For Your Subscription.